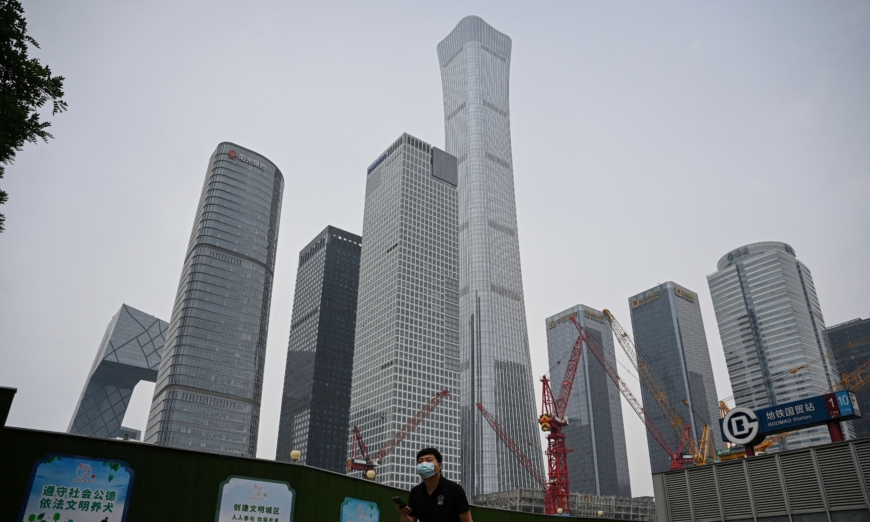

Foreign investments have continued to flee China as the country’s economy remains sluggish. Experts pointed out three major factors causing it.

Since last December when Beijing abandoned the restrictive “Zero-COVID” policy, foreign investors were optimistic about the Chinese market. Foreign investment poured back into China in the first few months of this year, but this recovery quickly lost momentum.

Geopolitical Tensions

Relations between China and the democratic nations have been deteriorating due to the Chinese communist regime’s aggression in the international community, especially over the Taiwan Strait and the South China Sea.

The United States is increasing its military presence in the Indo-Pacific region, partnering with nations such as Japan, South Korea, and the Philippines in improving cooperation through joint military exercises and training to contain communist China. U.S. Navy ships have also increased their presence in the Taiwan Strait to maintain peace and provide support to its allies.

North American investors are growing wary of putting money in the Chinese market as Washington is discussing new investment screening against Beijing. Canada’s Ontario Teachers’ Pension Plan suspended direct investment in China in January. Warren Buffett has sold more than half of his stake in Chinese electric car group BYD in the past year and plans to increase his holdings in Japanese stocks.

Warren Buffet (L), CEO of Berkshire Hathaway, and Bill Gates, founder of Microsoft, speak at the BYD auto manufacturer in Beijing on Sept. 29, 2010. (Frederic J. Brown/AFP/Getty Images)

Some banks have already started to shelve investment plans in China to avoid U.S. sanctions.

The head of Goldman Sachs’s Private and Growth Equity in Asia Pacific, Stephanie Hui, said she had halted attempts to raise capital in the United States because of geopolitical tensions between Washington and Beijing.

Participation by foreign banks in China’s IPOs has fallen to the lowest level in more than a decade. In 2023, in China’s stock market, not a single American bank participated in the 109 new IPOs, according to Financial Times.

Foreign financial institutions and investors are already taking steps to reduce investment in China while increasing their holdings in Asian countries.

Meanwhile, listings of Chinese companies in New York, once a lucrative business, have decreased due to Beijing’s data control and stricter U.S. audit scrutiny.

Data Blocking, Totalitarian Policies

The Chinese Communist Party (CCP)’s strict control of data sharing has made it more difficult for foreign executives to understand business conditions in China.

Several global bank executives told Financial Times that they were hesitant to list in China because it was difficult to conduct the reviews required by internal bank procedures. And they are looking for a more favorable investment environment to replace China.

Chen Songhsing, director of the New Economic Policy Research Center of Donghua University in Taiwan, told The Epoch Times that China lacks transparency in its macroeconomic and corporate data.

“Recently, they also put out the new anti-espionage law, confidentiality protection, etc. Foreign investigative firms have been targeted by the communist regime, and the four major international audit firms’ offices in China have been scrutinized. The credibility of the financial statements of Chinese companies is getting worse and worse, and audits are not allowed, so there isn’t sufficient protection for investors,” he said.

The “Big Four” accounting firms are PricewaterhouseCoopers (PwC), Ernst & Young, KPMG, and Deloitte.

Chen explained: “The first principle of investment is to provide complete and accurate information. If the data provided is incomplete, it has basically violated the protection of investors. Therefore, from the perspective of investor protection, Wall Street investment banks have no way to convince their investors that their investment [in China] is protected.”

U.S.-based economist Davy J. Wong told The Epoch Times that “the Chinese stock market is often dominated by taking advantage of and trapping individual small buyers within a closed environment. And it has various under-the-table channels within the environment to spread various unverified information to swindle stock investors. So even if there is a lack of foreign investments, they [CCP] can still make money from domestic stock investors, and they don’t necessarily need foreign banks to invest.”

Chen said the CCP makes bad decisions, such as the “zero-COVID” policy and cracking down on private enterprises, and the regime is becoming more and more totalitarian.

Economic Downturn

Wall Street banks have lowered China’s GDP growth forecast for this year. For example, Goldman Sachs’s analysts lowered China’s 2023 gross domestic product (GDP) growth forecast from 6 percent to 5.4 percent. They also lowered China’s 2024 growth forecast from 4.6 percent to 4.5 percent.

According to public data, China’s real estate industry, which accounts for about 20–30 percent of China’s GDP, and its related industries have continued to slump. In April, the sales floor area of China’s new homes fell by 11.8 percent year-on-year, a sharper decline from the 3.5 percent drop in March.

Chen said that real estate is the major driving force of China’s economy, accounting for nearly 30 percent of the economy. “When it’s [real estate sector] in decline, it will be difficult for China’s economy to improve.”

People attending a job fair in Beijing on Aug. 26, 2022. (Jade Gao/AFP via Getty Images)

Meanwhile, the unemployment rate in China has reached an alarming level. According to the official data, the unemployment rate of those aged 16 to 24 has exceeded the 20 percent mark. Chen believes the official unemployment rate is being underreported, and the actual figure should be higher.

China’s central bank has also been lowering interest rates to boost consumption, but low-interest rates have meant a weaker yuan, which crossed the psychological threshold of 7 yuan against the U.S. dollar on May 17. This will also lead to a widening of the U.S.-China capital yield gap, keeping investors away from the Chinese market.

“China’s economy currently lacks momentum, because the people have no confidence and weak confidence in consumption. Therefore, under such circumstances, the future prospects of the Chinese economy should theoretically return to the original point of investment in infrastructure construction and investment in railway and public infrastructure. However, the heavy debt load of local governments makes financing for infrastructure very difficult, almost impossible to continue,” Chen said.

He added: “It is unlikely that the Chinese government would propose new policies right now. It is quite difficult for China to recover the withdrawn foreign capital or attract more investment to China.”

“Now, China’s economic growth is in a downward trend, and it’s a long-term trend. The yuan is expected to depreciate and is devaluing. If you invest in it [Chinese market], you may lose money. I think everyone has to wait and see,” Chen said.

Wong said that in the past, Wall Street investment banks had brought huge amounts of overseas investment, technology, and business ventures to China. Now, with lowered growth expectations, “they may consider transferring all those to Southeast Asia and reducing the scale of investment in China,” he said.

Song Tang and Yi Ru contributed to this report.